Every year, China’s Singles Day -- the world’s biggest online shopping event -- manages to top its scale and performance from the previous year. Despite the ravages of coronavirus -- or possibly because of them -- Singles Day 2020 promises to double up on its singular focus by expanding the scope of Singles Day itself. In fact it’s already begun.

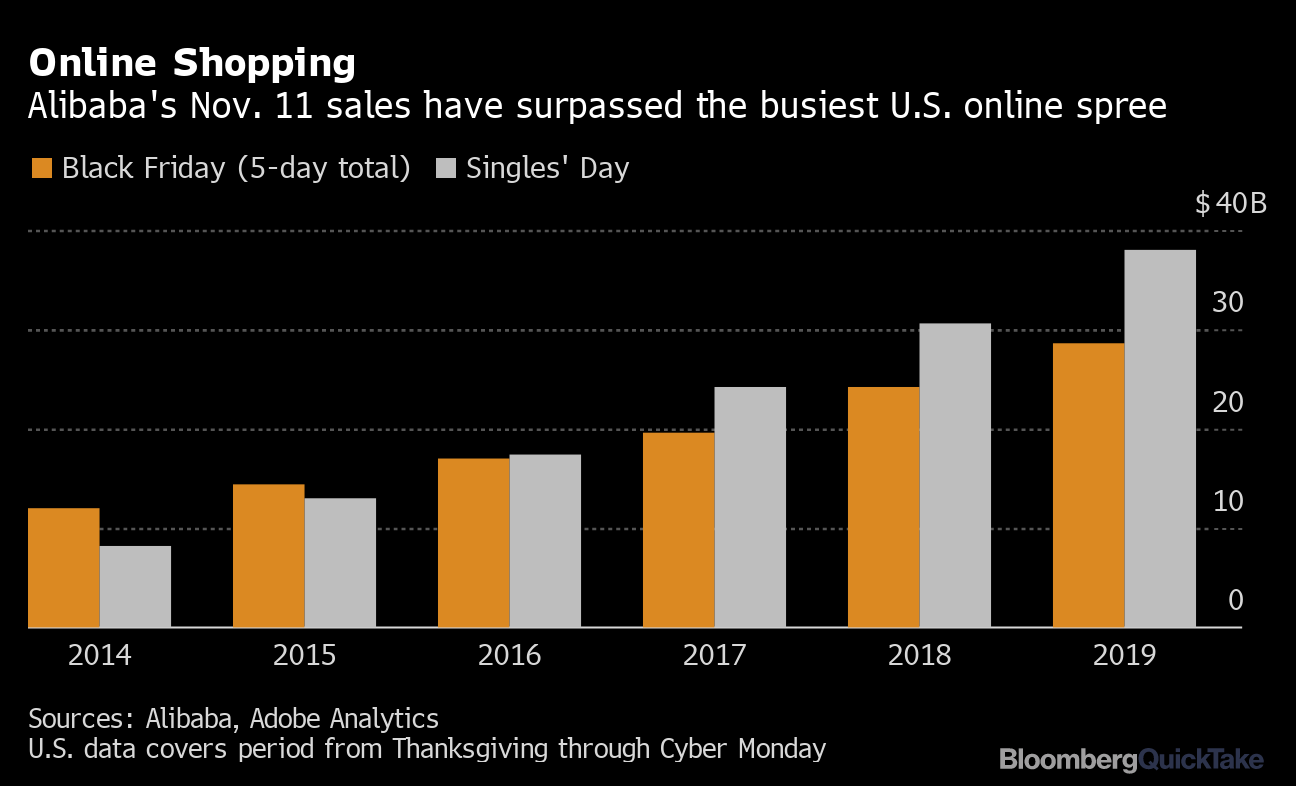

Alibaba, the Chinese e-commerce giant behind Singles Day, offered retailers the opportunity to promote their brands and products early, essentially letting consumers get a good look at what deals they could score during what is now the largest consumer spending event in the world. For scale, consider the following figures:

2019: Singles Day = $38 billion USD

2019: Cyber-Five = $28.5 billion

2020: Amazon Prime Day = $3.5 billion USD

On a single day, Singles Day dwarfs consumer spending across the entire Cyber-Five period.

2020: A sea change for e-commerce globally

Against a global backdrop of Covid-19 keeping people away from in-store retail experiences, a permanent adoption of online shopping for everyday essentials, and a new round of lockdowns coming into force during prime holiday shopping time in Europe and the US, it’s probably true to say that we’ve reached a tipping point for e-commerce. As consultancy firm McKinsey observed: “we’ve covered a ‘decade in days’ in the adoption” of digital; consumers’ lives are changed across the board, but shopping seems to be the stickiest change. Consumers worldwide have welcomed online shopping endeavors as a permanent part of their lives.

Post-pandemic China: Ready for shopping spree

China was already a leader in e-commerce adoption before Covid hit. And now, with the pandemic mostly behind them, China has moved forward with robust economic growth and an apparent rebound in consumer confidence. They are ready for a shopping spree. It’s reported that consumers in China expect to spend more in 2020 than in 2019.

Hit a Singles Day home run: Pre-holiday e-commerce trends

What will this rosy e-commerce outlook mean for retailers, brands and the technologies that power e-commerce platforms?

Global brand demand

Each year, Chinese shoppers demand more and better deals from global brands. As the shopping holiday has grown, this has meant that Singles Day has become big business for global brands and companies worldwide. This year is no exception, with the event becoming more global, increasing the number retailers who are getting in on the action -- including usually promotion-shy luxury brands.

Particularly this year when, despite the health of certain e-commerce categories, luxury and non-essentials have suffered, it’s a good time for ‘western’ brands to join in on an established shopping event with built-in demand. Chinese consumers had long driven demand for some of the biggest brands, particularly in the luxury sector, but with travel at a standstill, American and European brands can recoup some of the losses by tapping into Singles Day.

Live streaming takes the lead: Conversion from browse to buy

As Singles Day retailers have continued to innovate, live streaming has gone from an understudy to center stage. Retailers who adopted live streaming in their Singles Day mix saw immediate increases in live-streaming commerce gross merchandise volume (GMV). With this instant success, more retail segments and categories have joined the fray, including cosmetics, electronics, automotive, and luxury goods.

Assuming that live streaming will be a part of a retailers’ strategies, using behind-the-scenes technology to power resilience and capacity will be essential to creating immersive and seamless experiences.

Mobile first and 5G -- Expanding shopping on-the-go

Mobile e-commerce had a rough go of it in previous years, but 2019’s Singles Day cemented the dominance of mobile as a leading shopping channel. Singles Day has in many cases turned to mobile-first approaches.

As 5G rolls out across China (and worldwide), this mobile-first shift looks to transform how people shop. Not only will 5G contribute an additional $12 billion USD in mobile commerce revenue in its first three years, according to an Adobe Digital Insights report, it will open up new opportunities to simulate the in-store shopping experience by enabling augmented reality, virtual reality and internet of things technologies that depend on the no-latency promise of 5G.

Tapping into the possibilities of 5G and its capacity will also require the right technologies for making the most of 5G and the edge.

Singles Day: In a league of its own or predictive indicator?

As the 11th annual Singles Day approaches, there remains little doubt that this is the world’s pre-eminent e-commerce event, and it both overshadows and outshines others. Despite being in a league of its own, it shines its light on global e-commerce. That is, global brands and retailers are increasingly important to the success of the holiday -- and are key demands of the Chinese buyer. At a time when a number of retail sectors are reeling from coronavirus-related losses, the Singles Day opportunity can’t be underestimated.

Similarly, as Singles Day leads the way each year, introducing new innovations and technologies to the shopping experience, other retailers hoping to capitalize on creating better consumer experiences have an expert example to follow, whether for the Black Friday/Cyber-Five weekend that closely follows Singles Day or for longer-term, sustained e-commerce success and customer relationship building.