In the diverse Asia-Pacific (APAC) region, over-the-top (OTT) video streaming has exceeded growth expectations and become a compelling entertainment source for consumers across the entire region. According to recent research, OTT has hit critical mass. To strike while there’s still opportunity to make inroads in one or many of these markets, it’s time to tap into both regional content preferences and the technology that will enable future-proof OTT streaming.

OTT in APAC: Bigger growth than expected across the region

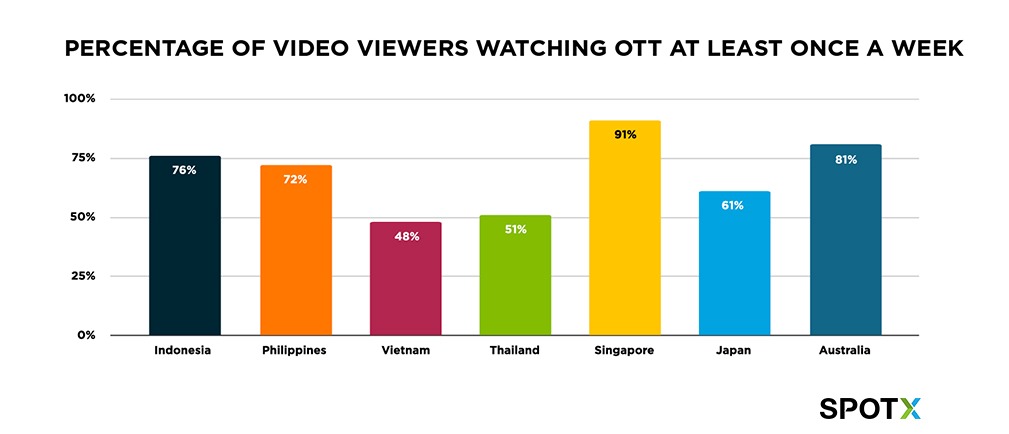

With more than 400 million OTT subscribers regionally, OTT is outpacing growth forecasts and driving OTT streaming into the dominant consumption model in Singapore, Australia and Indonesia in particular. While the opportunity for growth remains, OTT video is already in the mainstream in a number of advanced markets. Several markets, such as the Philippines and Australia, watch more OTT than regular TV, and this trend is set to continue as more services enter the market and better connectivity makes choice possible.

OTT across devices: Mobile-first? Smart TV?

While many markets continue to see the use of smart TVs growing (such as Australia, Singapore and Vietnam), the mobile-first approach to OTT viewing is growing faster. Mobile is the viewing platform of choice for 66% of APAC consumers.

OTT for free? APAC consumers demand different consumption models

Unlike their counterparts in Europe and the US, the APAC region has varying levels of success with subscription-based OTT models. In general, consumers appreciate having a range of choices as what means of exchange they want to use to consume content. Where one market is conditioned for a monthly subscription fee, another is willing only to pay on a per-use basis or will tolerate ad-supported content in exchange for having OTT for free. In most of Southeast Asia, advertising carries OTT and will account for up to 74%of online video revenue by 2024. Only Australia, New Zealand and China prefer to pay to avoid ads.

Some of the tolerance for ads is cultural, but some may be contingent on the type and quality of content on offer. If the content is popular or in high demand, it might command a price. If the quality of the stream is better, maybe this is worth paying for. These factors will vary by technology and market, of course, and will have to be considered in terms of what regional and international competition exists within each market.

Localizing content for the local audience

What will differentiate the highly competitive OTT landscape, apart from the cost models, is content. As global players like Netflix and Amazon enter the scene, the window for differentiating with localized content might be narrowing. For local and regional players, a comprehensive strategy that folds localized content and localized understanding of consumer behavior together may help in remaining competitive where global competitors don’t have local understanding.

Simplifying OTT: Isn’t content delivery local, too?

Once the pricing and content models are decided, one of the biggest barriers to OTT is the actual content delivery. APAC is no monolith in terms of population, language, or consumer preferences, and, most of all, in terms of technology and infrastructure.

For local and regional OTT providers, the biggest challenge might be dependent on the infrastructure that’s in place. Delivering content via a global CDN provider, for example, where the closest point of presence (PoP) is possibly in another country, content delivery isn’t really local. On some level, maybe this won’t matter. But for delivering OTT video content, performance has a lot to do with where these PoPs are located. The closer they are to the consumer, the better for the user experience. This is ultimately better for the consumer -- and for the OTT provider or broadcaster.

Why?

- Reduced latency for local/regional users, especially for live sports

- Reduced data transport costs

- Reduced/more predictable costs for CDN itself (cutting out the middle man)

- Better compliance with local data regulations

- More options for resilience and backup

- The multi-CDN model further reduces costs by using different CDN providers for different regions or even private CDNs

A local PoP/multi-PoP proposition helps content providers take advantage of greater flexibility than global commercial CDN options to remain more competitive in a rapidly changing OTT landscape.